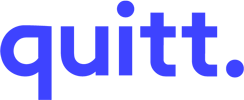

quitt handles the payroll of over 20'000 domestic helpers in Switzerland and therefore knows the average hourly wage employers pay…

Where do I have to officially register as a private employer of a domestic help?

If you employ a domestic help, you are obliged to pay social security contributions. In private households, every paid activity is subject to contributions.

As a private employer, you must always register with the cantonal compensation office (AHV) at the place of your household where the work activity takes place.

However, if your monthly salary exceeds CHF 1,777.50 (or CHF 21,330 per year), you must also register your household help with a pension fund and, in the case of foreign employees, with the relevant tax authorities.

quitt. takes over all registrations with the authorities for you as an employer. Thanks to the information you provide when registering, quitt. knows which authorities are relevant for your employment relationship.

This quitt.blog post could also be interesting for you:

→ Can a domestic helper “settle the AHV itself?”